Top 10 Traders of All Time: Stock Market traders have created financial history with trades that significantly impacted markets and generated massive gains. From shorting currencies to predicting market crashes, these traders have shown remarkable skill in market trends and taking bold positions. Their bold moves didn’t just profit them, they influenced market behavior, sometimes triggered wider market movements.

For instance, George Soros’s infamous bet against the British Pound in 1992 not only made him $1.5 billion but also shook the world currency markets. Similarly, Paul Tudor Jones’s forecast of the 1987 market crash showcased the power of technical analysis in anticipating major shifts. Traders like them have established how the right strategy, risk management, and timing can lead to financial success. Understanding their actions offers insights into how markets can be influenced by key players, turning analysis and instinct into financial gain.

George Soros

Soros concreted his place in financial history with his fabulous trade in 1992, famously “Breaking the bank of England.” Soros made a bold move by shorting the British pound, betting on its devaluation, and earning an astonishing $1.5 billion in profit.

This trade wasn’t just about profit – it determined his deep knowledge of macroeconomics trends and his ability to act decisively when others hesitated. Soros’s legacy extends beyond his trading success, he’s known for his philanthropic work and political activism, making him one of the most influential figures in both finance and global affairs.

Paul Tudor Jones

Paul Tudor Jones showcased his excellence by accurately predicting the 1987 stock market crash, known as Black Monday. Using his expertise in technical analysis, he saw the warning signs and took a contrarian approach, shorting the market when others remained bullish.

His boldness paid off, earning him a staggering $100 million in a single day. Jones ability to anticipate market movements and take swift action sets him aside as one of the finest traders. His career is marked by a deep understanding of market psychology and risk management, solidifying his reputation as a trading legend.

Jesse Livermore

The 1929 market crash remains one of the most devastating commercial events in history, but for Jesse Livermore, it was a moment of remarkable insight. He saw the collapse coming and positioned himself to profit by shorting the market, buildup a fortune of $100 million during the great depression.

Livermore’s keen understanding of market cycles and his willingness to act decisively in the face of turmoil set a high standard for traders to follow. His pioneering strategies in speculation and risk management continue to inspire traders who seek to master the art of market timing.

John Paulson

The 2008 financial crisis shook the global economy, yet John Paulson’s bold bet against subprime mortgages turned out to be one of the most lucrative trades ever. By recognising the unsustainable nature of the housing market, he strategically positioned himself to profit, earning $4 billion when the bubble burst.

His outstanding ability to see through market euphoria and pinpoint underlying risks is a testament to his sharp analytical skills. Paulson’s foresight during such a turbulent period compressed his reputation as a trader with an exceptional understanding of financial bubbles and the courage to act on it.

Jim Simons

Re-modeling the world of trading, Jim Simons utilized mathematical models and quantitative strategies to achieve consistently high returns at Renaissance Technologies. With his background in mathematics, he pioneered algorithmic trading, transforming complex data into highly profitable trades. His firm’s medallion Fund became famous for generating fantastic returns, year after year, defying market trends.

The precision and innovation in Simon’s approach reshaped modern trading, proving that data-driven strategies could outmatch human intuition. His groundbreaking work in quantitative finance left an indelible mark on the industry, setting a new standard for how markets could be navigated through science.

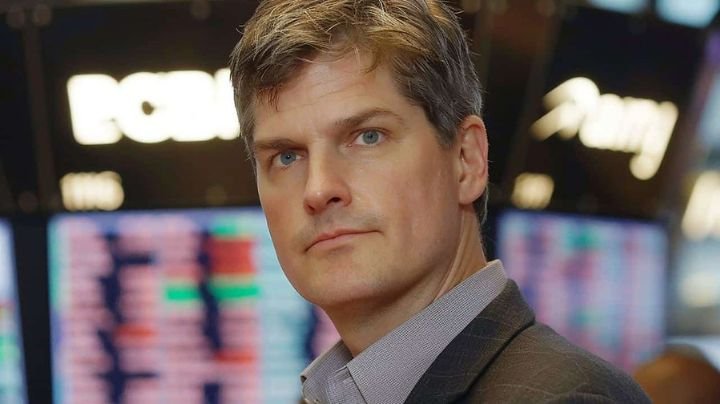

Michael Burry

Spotting the leaks in the housing market long before others, Michael Burry shows a level of insight hat few could match. By digging deep into flawed subprime mortgage bonds, he made a bold bet against the housing market, predicting its collapse in 2008.

His unconventional thinking and relentless analysis paid off, earning $700 million for his investors and proving that thorough research could uncover hidden risks. Burry success wasn’t just about profit; it was a proof to the power of independent thought in a market often driven by consensus. His legacy as a visionary remains undeniable.

Ray Dalio

A deep insight of market cycles and human behaviour underpins Ray Dalio’s innovative “All Weather” portfolio strategy. By designing a strategy that performs well in any economic environment, he accepted that smart diversity and asset allocation can mitigate risks while maximizing returns.

Founding Bridgewater Associates, the world’s largest hedge fund, further set his place in financial history. His holistic approach, blending economic principles with psychology, continues to inspire traders and investors. Dalio’s ability to navigate complex markets while anticipating shifts in the economic landscape speaks to mastery that is both rare and highly respected.

Warren Buffett

The success of Warren Buffett’s investment strategy stems for his disciplined focus on long-term value. Through Berkshire Hathaway, he corporated an affluence by identifying undervalued companies with strong fundamentals and holding onto them for the long haul.

His approach is rooted in patience, deep research, and a commitment to conservative investments, making him the “Oracle of Omaha.” Buffett’s strength to navigate markets with a steady hand, even during bumpy times, has solidified his reputation as a financial legend. His philosophy of value investing continues to shape the investment world, influencing generations of traders and investors.

Jim Chanos

Short-selling takes a certain boldness, and few have done it successfully as Jim Chanos. His legendary trade, shorting Enron before its tragic collapse, not only netted $500 million in profit but also exposed one of the biggest corporate frauds in history.

Chanos keen eye for financial irregularities and willingness to take on companies that seem invincible sets him apart in the trading organization. His work has reconsidered how traders approach corporate balance sheets, with a focus on uncovering hidden risks. Chanos legacy as a master of short-selling continues to resonate across financial markets.

Steven Cohen

Aggressive trading strategies have become synonymous with Steven Cohen’s approach to financial markets. Through his various hedge fund strategies, he has successfully built Point72 into a multi-billion-dollar fund, demonstrating an uncanny ability to navigate complex market dynamics.

His skill for short-term trades shows not just skill but an audacious confidence that many traders aspire to emulate. Cohen’s influence on the hedge fund industry is profound, shaping how traders think about risk and opportunity. His relentless pursuit of profit serves as an inspiration for those looking to carve out their own paths in the competitive trading landscapes.

Also Read:

Pingback: Top Life changing Books

Pingback: Best Trading Books for Beginners - Readers orbit